By Linda Straker

Any license to open a new bank in any of the Eastern Caribbean territories now lies in the hands of the Eastern Caribbean Central Bank (ECCB), and Governor Sir Dwight Venner has promised that whenever such an approval is granted, it will be after in depth scrutiny of the applicant, those who will invest, and also those who will administer its operations.

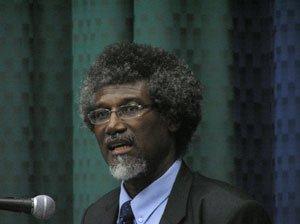

That was the announcement from Sir Dwight Venner, Governor of Eastern Caribbean Central Bank, when he held a regional press briefing last week Wednesday to discuss the “Resolution Strategy for ECCU Financial System.” Explaining that the due diligence will be rough and vigorous, he said that Banking is one of the most significant activities in any economy, and our countries have a very high exposure to banking activities. “Commercial banks, along with the government sector, are the largest and most sophisticated actors in our economies,” he said.

Recently, parliaments of each member state approved a new harmonised banking legislation — this piece of legislation attempts to address major issues in the banking sector following the fallout from the global recession. It also seeks to correct the deficiencies of the previous Act, to ensure that each ECCU member state legislation is compatible with international standards, in order to pre-empt any future crisis, as this will enable the authorities to resolve failed banks more efficiently and effectively, to protect depositors, and to maintain financial stability.

“The licensing of companies and individuals to carry on banking business is therefore a very serious and risky business, since the failure of a bank can have a tremendous negative impact on personal lives, both as individuals and as a society,” said the Governor.

“The due diligence will be very rough as we cannot let scamps to open a bank,” he said, while explaining that some of the due diligence will include regular police background checks, as well as former or present business involvement and activities.

“The criteria for establishing a bank has been considerably enhanced, the promoters must be of sound character, and they must put up sufficient capital to show that they are capable of financing such a serious venture of real public significance,” said Venner, who explained that the investor must also put in place the systems to identify and mitigate the risks that such an institution faces.

Besides the due diligence, the Governor said that the critical areas that regulators need to access in order to ensure the safety and soundness of a bank, will be sufficient capital to absorb losses and adequate liquidity to meet withdrawals of deposits under normal circumstances, and to meet the demands of its creditors.

The bill itself provides the opportunity for a wide-ranging discussion on these very important development issues, which are so critical for us at this crossroad in our economic history. A lot of the discussion thus far has been focused on very narrow individual interests and personal animus towards the Central Bank; this is an insular and inward-looking approach which is out of sync with the global environment in which we exist.