by Linda Straker

- Amendment to Tax Administration Act approved Tuesday

- Cornwall became Finance Minister as of 1 April

- Over EC$777 million in outstanding taxes, late fees, and penalties

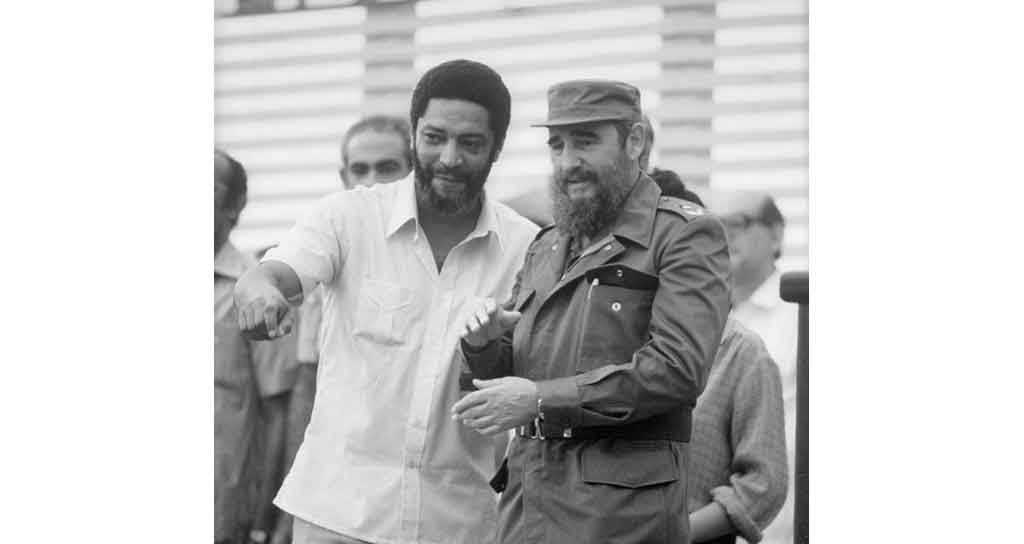

Finance Minister Dennis Cornwall has warned that he will have no mercy on taxpayers who fail to settle their outstanding tax debts to the Government during the tax amnesty on late fees and penalties period, which expires on 31 December 2023.

Prime Minister Dickon Mitchell disclosed in December 2022, while presenting the 2023 budget statement that the government is owed millions in outstanding taxes. A tax amnesty was introduced in January 2023 to encourage citizens to pay outstanding taxes backdating to December 2021. This means that taxpayers must pay only the taxed amount and not the interest, late fees, or penalties.

The House of Representatives or the Lower House of Parliament on Tuesday approved an amendment to the Tax Administration Act to provide for the amnesty period because the current legislation did not provide for an amnesty.

Cornwall, who became Finance Minister as of 1 April, in his contribution to the Bill, told members that he will not offer mercy to those who failed to clear their outstanding debt with Government following the amnesty period. “I want to send this warning, as Minister of Finance, if I ever had the opportunity after this amnesty is over and there are people out there who have not taken advantage of this thing, I will have no mercy to enforce the law,” he said.

“Amnesty sometimes is good, but it’s not the ultimate solution to the problems that we face in taxation. There are those of us who believe that we can always fix the bill, put it that way, and not pay the tax… To some of us who don’t understand that Government can sell your property, those properties that probably you are going to hold for your kids down the road because you are trying to avoid paying tax,” he added.

Prime Minister Mitchell said that over EC$777 million is owed in outstanding taxes, late fees, and penalties. The Tax Administration Act, enforced in 2016, said in Section 62, “If a person fails to pay tax when it is due, the Comptroller may commence proceedings in a court of competent jurisdiction to recover the debt.”

Please I will like to get my tax refund.

Reckoning take time on ALL sides to ensure accuracy. An even better idea is for no more tax breaks given to developers. If Grenada is such a good investment then NO CONCESSIONS are necessary for ANY company to build in Grenada. No more free sea cans of imported goods for the hotels when everyone else must pay 40% on every item received. You can’t allow businesses to avoid paying taxes by operating as a foreign owned entity claiming no taxes owing to Grenada. You know which businesses make enough profit and must file tax returns and individuals the same. Most average small persons barely make enough to eat much less pay income taxes.

This information as reported by the Minister is totally incorrect as IRD has people owing who has paid their taxes. Do not know where the payment went. I am speaking facts. Thus before such is published, the Minister and the Department needs to ensure that the figures reported are correct.

The Finance Minister and his cohorts should find alternative measures to raise money for the government instead of threatening its citizens. Stop using the law to coerce instead of doing your jobs you were elected for.

There is and should be consequences for not paying taxes. Rich folks are unscathed but poor people pay. On the other hand, Grenada’s economy is too tax based and lacks serious investments.

How it is possible to allow outstanding debt to get this far. Some live the good life will the poor suffering.

Tbh these are only government estimates of taxes owed.

The government doesn’t actually know how much is owed, it’s based on the last time someone filed, if my business performed badly in the years after filing they won’t know

Tax avoidance is quiet normal the US has worse compliance than grenada

Its very hard for the government to control this(unless they implement cbdc)

I do agree that the minister’s choice of words was terrible.

Many people don’t know how to do their taxes properly, lets educate and make the process easier first before selling someones property, imagine if you made a mistake in your tax filing and the government sells your property years down the road.

Government also needs to do their part, you want taxes to be paid yet you owe citizen money from court cases lost over the years.

Maybe I should take the government to court for taking so long to pay.

The Petite Bourgeois and business class are killing Grenada. How it is possible to allow outstanding debt to get this far. Some live the good life will thd poor suffering.